I’ve recently been doing a review of my investments and retirement goals. I was made redundant in early 2023 and made an estimate on how long my savings would last. While it wasn’t enough to retire on it was a good percentage of the way there.

I got a new job after a few weeks but I decided to make some more detailed calculations to see how much I would really need and if I was on track.

Note: That all numbers in the blog post are 2023 New Zealand dollars and I’m assuming are inflation adjusted.

My Situation

I am a New Zealand citizen living in Auckland, New Zealand. I work in IT and have a stay-at-home partner and no children. We rent and don’t own property. We have Investments in Managed Funds and Term Investments plus Kiwisaver Retirement accounts. I am not including any inheritance.

Our total expenditure is around $50,000 per year. About half this is rent. This doesn’t include major purchases ( eg a replacement car ) or travel.

Why retire early?

The big reason to retire early is due to declining health and life expectancy. At 55 I can expect till live till around 85. Which probably means I’ll die in my 80s. If I’m lucky I’ll be able to be fairly active till 70 but probably not past that. Almost certainly at either myself or my partner will be unable to do active activities (eg walking around a city all day or tramping) by 70.

This means if I retire at 65 I might get 5 years of active retirement. Whereas retiring at 55 could give me 15 years, 3 times as much. If I get sick at 67 then the difference is even greater 12 years vs 2.

Retirement scenario

My working scenario is that I will retire at 55. We will then spend $70,000/year for 5 years on extra travel etc. Then $60,000/year in our 60s followed by $50,000/year from 70 onwards.

New Zealand Superannuation will kick in when we each turn 65. This provides around $15,000 after tax for each person.

Running the numbers

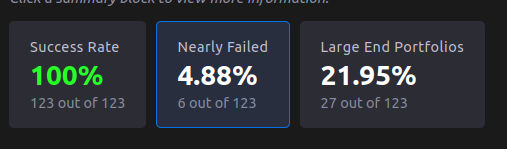

So to test this out I’ve been using a free app/site called ficalc.app . It lets you plug in your retirement length, portfolio and spending and it will run it against every starting year (in the US) since 1871. It will then show you the success rate including the “nearly failed”.

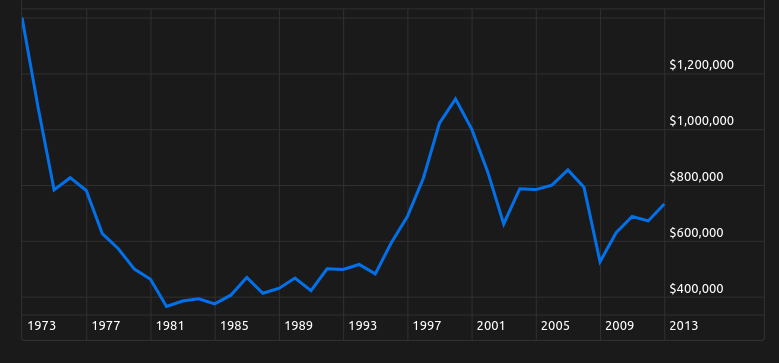

A hard year to check against is 1973. A falling stock market and high inflation wipe out a lot of your savings at the start so you need a good initial amount to keep ahead of your later withdrawals.

I found I would need around $1,350,000 starting amount for every year to be successful and no near failures for a 30 year retirement. The numbers were virtually the same for 40 years.

However if I adopted the Gayton-Klinger Guardrails strategy and spend up to $5000/year less when my portfolio was down I could get away with just $1,200,000 saved.

The result

It appears that we will need around $1.2 to $1.35m (in 2023 $NZ) to retire at at 55 with my assumed spending patterns. At my current saving rate there is a good chance I could reach this.

Delaying retirement beyond 55 to save more money loses healthy years of retirement with not a lot of upside in risk reduction. However a delay of a year or two greatly improves the expected outcome so it is an option if things look tight.

There will always be some risk. ie a Stockmarket Crash, financial loss, costs increase (eg rent) or health event could cause problems and I would no longer be working to adjust to it.

We also won’t have a lot of spare money to voluntarily spend on things. eg a $40,000 on an extended holiday wouldn’t be in the budget and would be hard to save for.

I ran the numbers assuming I buy rather than rent. However since Auckland housing prices are so high compared to rents it doesn’t seem to be significantly worse than paying rent out of savings.

Resources

- My base chart at ficalc.app

- James Shack has some Youtube videos on why your should retire as early as possible.

- NZ Superannuation rates